This is a sponsored post written by me on behalf of Nationwide Mutual Insurance Company. I purchased my own insurance at normal prices. All opinions are 100% mine.

Nationwide provided me with information regarding its SmartRide program.

A few months ago I shared that Dave and I had signed up for the Nationwide SmartRide program. We have been Nationwide auto insurance customers since we were married, and I was interested to find out that they offer a program where we have the potential to earn discounts on our policy according to our driving habits. We’re currently about half-way through the program, which typically lasts for one full policy cycle, and so far we’re on track to earn great discounts and have learned a lot about how we drive.

- Miles Driven, statistics show that on average, the more miles driven the higher the chances of an accident

- Hard Braking, considered as decelerating faster than 7.7 mph per second

- Fast Acceleration, considered as accelerating more than 7.7 mph per second

- Night Time Driving, miles driven between midnight and 5 am

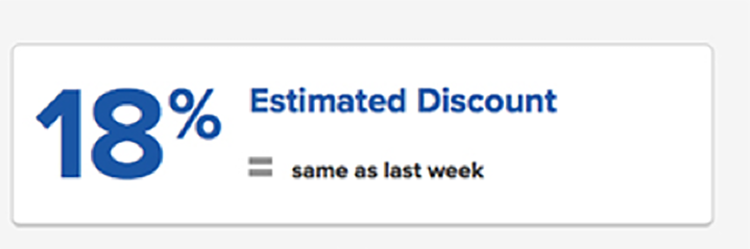

I decided I would wait a few weeks to start paying close attention to the results, so I could find out what my normal driving habits looked like before trying to improve. That worked out easily because Dave was receiving all of the email updates and I almost forgot about them! Once he started sending the summaries over to me I began really considering the data. As of now, halfway through, Dave is on track to earn an estimated 18% discount and I’m on track to earn an estimated 5% discount. Let me break down the results a bit.

Dave’s only regular yellow flag on the summaries is driving too many miles. According to the SmartRide system, anything over 90 miles per week is considered excessive, and Dave has a 15 mile commute. So to work and home 5 days in the week he maxes out his miles and ends up in the yellow. Most of his weeks have zero hard braking events, zero fast acceleration, and zero nighttime driving. Out of a possible earned 40% discount, those extra miles seem to bear a lot of weight, but we’re thrilled with the discount he’s on track to earn and hope to keep it up until the program ends in April and we can lock it in for the life of our policy.

The other area where I am not doing as well in the SmartRide program is in total miles driven. It looks like I average driving about 300 miles per week, some a little more, some a little less. We live in suburban Austin, and nothing is very close together. Between taking kids to school, getting groceries and running errands, driving to the gym twice a week, regular meet-ups downtown for work, and at least one or two fun adventures with the kids per week to a museum, the zoo, or a nearby town for a weekend trip, I rack up the miles pretty easily.

Neither Dave nor I drive at all after midnight. At midnight we’ve been in bed for two hours usually, so our nighttime driving gets an A+. We also aren’t fast accelerators, having only a handful of fast accelerations in the last three months between us. Generally, we’re both safe and defensive drivers, and aren’t usually in a hurry. According to our SmartRide results, the element of my driving that I can and hope to improve is focusing on braking more slowly.

A couple ways that I’ve been working on that is by moving my seat back a little bit so I’m not right on top of the brake pedal, which decreases my chance of stepping hard. I’ve also been conscious of watching the lights ahead of me, and slowing down sooner for upcoming yellow lights. Little adjustments that may contribute to a higher discount, and regardless will contribute to safer driving overall.

I’m excited to finish out our last few months on the program and see where we end up with our potential discounts. It has been really simple and low maintenance to participate, and the idea that we will be able to lock in some savings for years to come is awesome. Every little bit counts!

Created in partnership with Nationwide Insurance Company. All ideas and experiences are my own.

Nationwide asked that I include this information about the product: Products underwritten by Nationwide Mutual Insurance Company and Affiliates. Columbus, Ohio. Availability varies. Discounts do not apply to all coverage elements; actual savings vary by state, coverage selections, rating factors and policy changes. Enrollment discount applies during data collection; final discount is calculated on driving behavior and could be zero. Final discount applies at the next policy renewal and remains until drivers or vehicles on the policy change.